how are 457 withdrawals taxed

For this calculation we assume that all contributions to the retirement account were. The minimum withholding rate of 10 applies to the first 1000 and the 20 rate applies to the additional 2000 withdrawn.

Beneficiary distributions avoid the early withdrawal penalty of 10 percent regardless of the age of the beneficiary.

. Withdrawals from 457 retirement plans are taxed as ordinary income. However distributions are still taxed as ordinary income. For more information see.

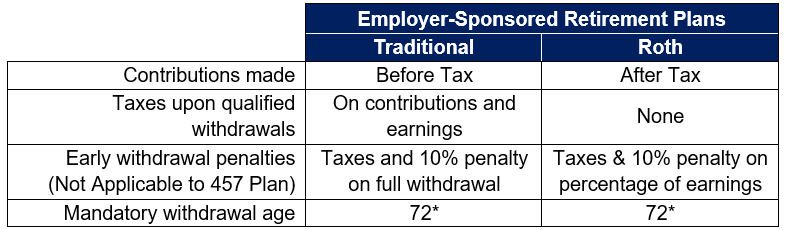

My question was related to 457 withdrawals which generate a 1099-R for tax season. Generally a distribution from a governmental section 457b plan is not subject to the 10 additional tax under section 72t. By contrast withdrawals from 401k and 403b accounts are taxed as regular income in addition to a 10 early withdrawal penalty.

As with other retirement accounts 457 distributions are taxed as ordinary income. For this calculation we assume that all contributions to the retirement account were. Can Your Roll a 457 Plan Into an IRA.

This increase in taxable income may result in some of your Social Security taxes becoming taxable. At what age can I withdraw from my 457 without penalty. So if you need to tap into your 457b contributions before you reach age 595 and youve left the job that provided you with the 457b dont fret.

Since the earnings are taxed during the withdrawal one could assume this is earned incomebut assumptions are not necessarily correct. However distributions received after the pensioner turned 59 12 would qualify for the private pension and annuity income exclusion of up to 20000. Once you retire or if you leave your job before retirement you can withdraw part or all of the funds in your 457 b plan.

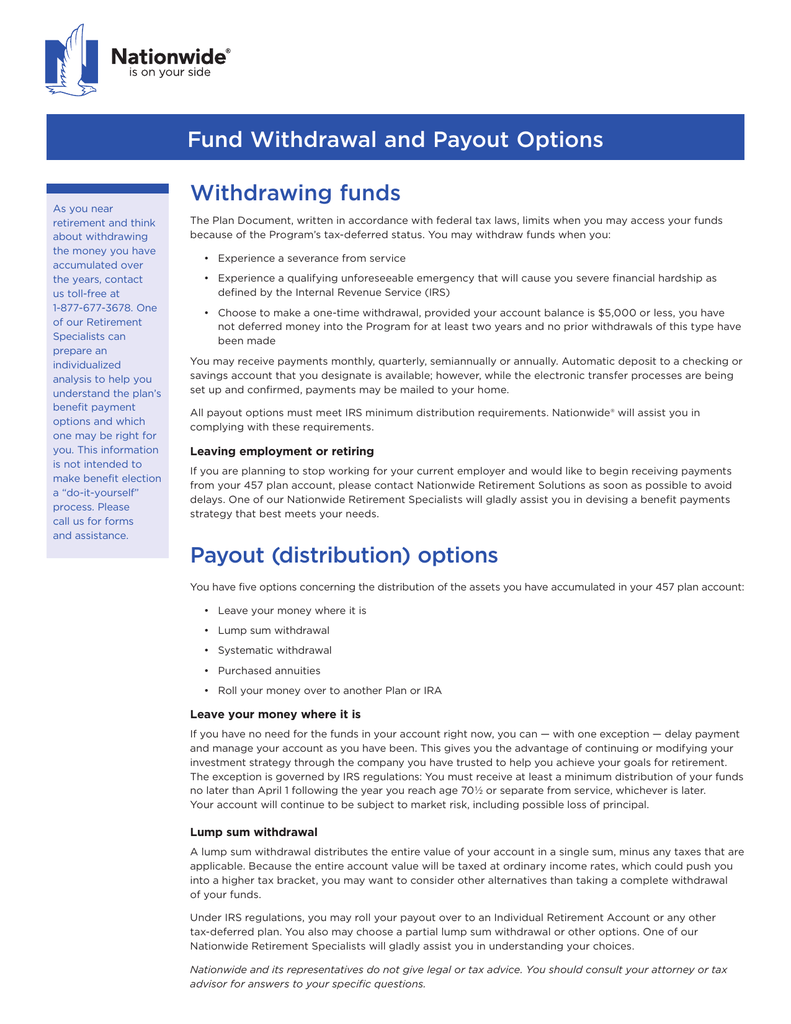

5 457b Distribution Request form 1 Page 3 Federal tax law requires that most distributions from governmental 457b plans that are not directly rolled over to an IRA or other eligible retirement plan be subject to federal income tax withholding at the rate of 20. Governmental section 457b plan distributions. All money you take out of the account is taxable as ordinary income in the year it is removed.

Withdrawals are subject to income tax. A 457b is a type of tax-advantaged retirement plan for state and local government employees as well as employees of certain non-profit organizations. 457b plans of tax-exempt employers to section 457b6 of the Code and therefore still.

Can I roll over my 457b into a Traditional IRA or employer- sponsored plan. This increase in taxable income may result in some of your Social Security taxes becoming taxable. If you have a 457 plan and you die your beneficiary can take distributions from the plan immediately.

Deferred Comp contributions do not show up on a W2 as earnings. Ad See How a 457b Could Help You Meet Your Goals And Save For Tomorrow. You will still however need to pay regular income taxes on that money.

Information for Seniors New York Treatment of Distributions relating to Section 457 Deferred Compensation Plans TSB-M-029I. You are age 76 and your required minimum distribution is 1000 but you withdraw 3000. This article will discuss in detail these new changes.

Ineligible plans may trigger different tax treatment under IRC 457f. What are the tax benefits of a 457 plan. Also 457 plan participants are permitted to roll.

There is no penalty for an early withdrawal but be prepared to pay income tax on any money you withdraw from a 457 plan at any age. 457 Plan Withdrawal Calculator Definitions Amount to withdraw The amount you wish to withdraw from your qualified retirement plan. 457 Plan Withdrawal Calculator Definitions Amount to withdraw The amount you wish to withdraw from your qualified retirement plan.

That means your distributions will be combined with any other income you have for the year with all of it putting. With a 457 retirement savings plan. If you made contributions that were subject to income taxes you may not owe taxes on the entire withdrawal.

An additional election to defer commencement of distributions from a section 457b plan and the cost of living adjustments to the 7500 limitation on maximum deferrals under a section 457b plan. There isnt an additional 10 early withdrawal tax although withdrawals are subject to ordinary income taxes 1 Theres a withdrawal option for unforeseen emergencies that meet certain legal criteria if all other financial resources are exhausted. Unlike other retirement plans under the IRC 457 participants can withdraw funds before the age of 59½ as long as you either leave your employer or have a qualifying hardship.

When do you have to start a 457 distribution. You can withdraw your money from 457 before age 59½ without a 10 penalty unlike a 401k but you will owe taxes on any withdrawal. You should consult your tax or legal advisor concerning your particular situation.

Withdrawals are subject to income tax. My question is still in search of an answer. How much tax do you pay on a 457 withdrawal.

457 Plan Withdrawal Withdrawing money from a qualified retirement account such as a 457 plan can create a sizable tax obligation. While the 457b shares a few features with. Just like other retirement plans you do need to start taking distributions from your 457 plan by the age of 70 and a half years old.

Once you retire or if you leave your job before retirement you can withdraw part or all of the funds in your 457 b plan. However an early distribution from. However distributions from a ROTH 457 plan are not subject to tax withholding.

All money you take out of the account is taxable as ordinary income in the year it is removed. How do I withdraw from my 457b. Withdrawals from a 457 plan would be entered in the TaxAct.

Is Alabama A Mandatory Or Elective Taxes 457 B Plan Ozark

Using A 457b Plan Advantages Disadvantages

Retirement Income Calculator Faq

/AP_401146136212-600579d89b014f62b098ed5ab375a3fc.jpg)

Are 457 Plan Withdrawals Taxable

New York City Deferred Compensation Plan

457 And Roth 457 Page 2 Focus Financial

The Most Tax Efficient Sequence Of Withdrawal Strategy Explained Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

A Guide To 457 B Retirement Plans Smartasset

Options Fund Withdrawal And Payout Options

How A 457 Plan Works After Retirement

Everything You Need To Know About A 457 Real World Made Easy

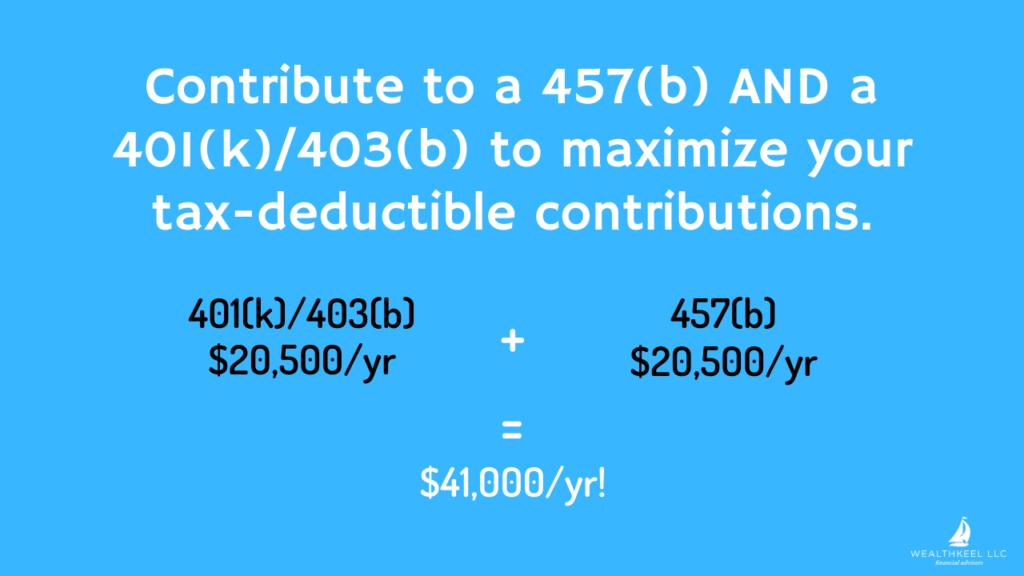

What Is A 457 B Plan How Does It Work Wealthkeel Advisors Llc